Currency derivatives are financial contracts whose value is derived from the exchange rate of two or more currencies. Common types include forward contracts, futures contracts, options, and swaps, used for hedging or speculation.

- Our Mission

Ensuring

Through extensive domain arranging, relish valuable's , guarantee a prosperous future the cycle early.

Advice

Our master guidance guarantees your cash helps your picked people and lines up with your aims.

Planning

Annuities help bequest arranging, excluded from legacy charge. Improve by safeguarding on tax-exempt.

- Our Capabilities

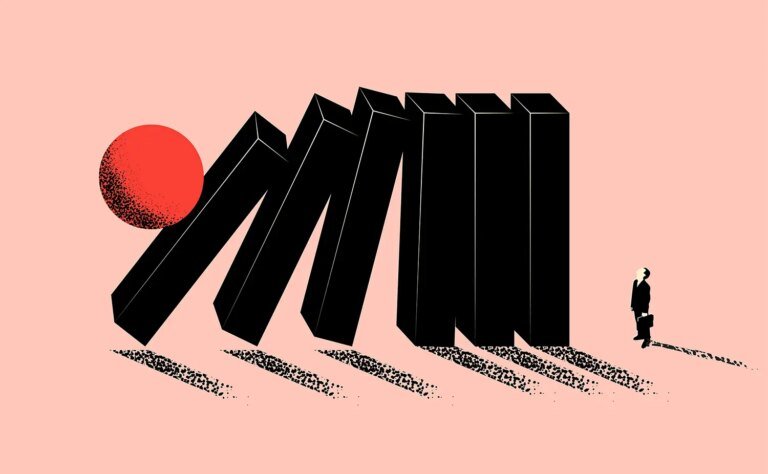

BENEFIT OF CURRENCY DERIVATIVES

Hedging

Hedging in currency derivatives involves offsetting risks by taking positions that counterbalance potential losses, protecting against adverse exchange rate movements, and ensuring financial stability.

Speculation

Currency derivatives speculation involves betting on future exchange rate movements to profit from price fluctuations, leveraging options, futures, or swaps without intent to hedge against underlying asset risks.

Arbitrage

Arbitrage in currency derivatives exploits price discrepancies between markets, buying low and selling high to make risk-free profits, ensuring market efficiency.

Leverage

Leverage in currency derivatives amplifies trading potential by allowing investors to control larger positions with smaller initial investments, magnifying both gains and losses.

High liquidity

Currency derivatives offer high liquidity, enabling swift transactions due to active markets. This liquidity facilitates efficient price discovery and risk management for participants in currency markets.

Less Transaction Cost

Currency derivatives offer lower transaction costs compared to physical currency exchanges, reducing expenses associated with buying and selling currencies, making it a cost-efficient option for investors.

Our process

01.

Client Onboarding

This step involves registering a new client with the brokerage firm. It includes gathering necessary personal information, completing regulatory paperwork, and establishing the client’s account.

02.

Investment Goal Assessment

Once the client is onboarded, the broker will work with them to understand their investment goals, risk tolerance, time horizon, and other relevant factors. This step helps determine the most suitable investment strategy for the client.

03.

Portfolio Construction

Based on the information gathered in the previous step, the broker will design a customized investment portfolio tailored to the client’s needs and preferences. This may involve selecting specific stocks, bonds, mutual funds, ETFs, or other investment vehicles.

04.

Ongoing Monitoring and Review

After the portfolio is constructed and implemented, the broker continuously monitors its performance and makes adjustments as needed. Regular reviews with the client help ensure that the investment strategy remains aligned with their goals and objectives. This step may also involve providing market updates, investment insights, and recommendations for portfolio optimization.

Currency derivatives are financial contracts whose value is derived from the exchange rate of a specific currency pair. These instruments, including futures, options, and swaps, enable investors to hedge against currency risk or speculate on future exchange rate movements in global financial markets.

Financial Planning.